kwsp withdrawal account 2

Oleh itu A perlu memberi notis selama. 2102012 A menghantar notis berhenti kerja kepada majikan.

11 Criterias That Allow You To Withdraw From Epf Saving Accounts L Co Accountants

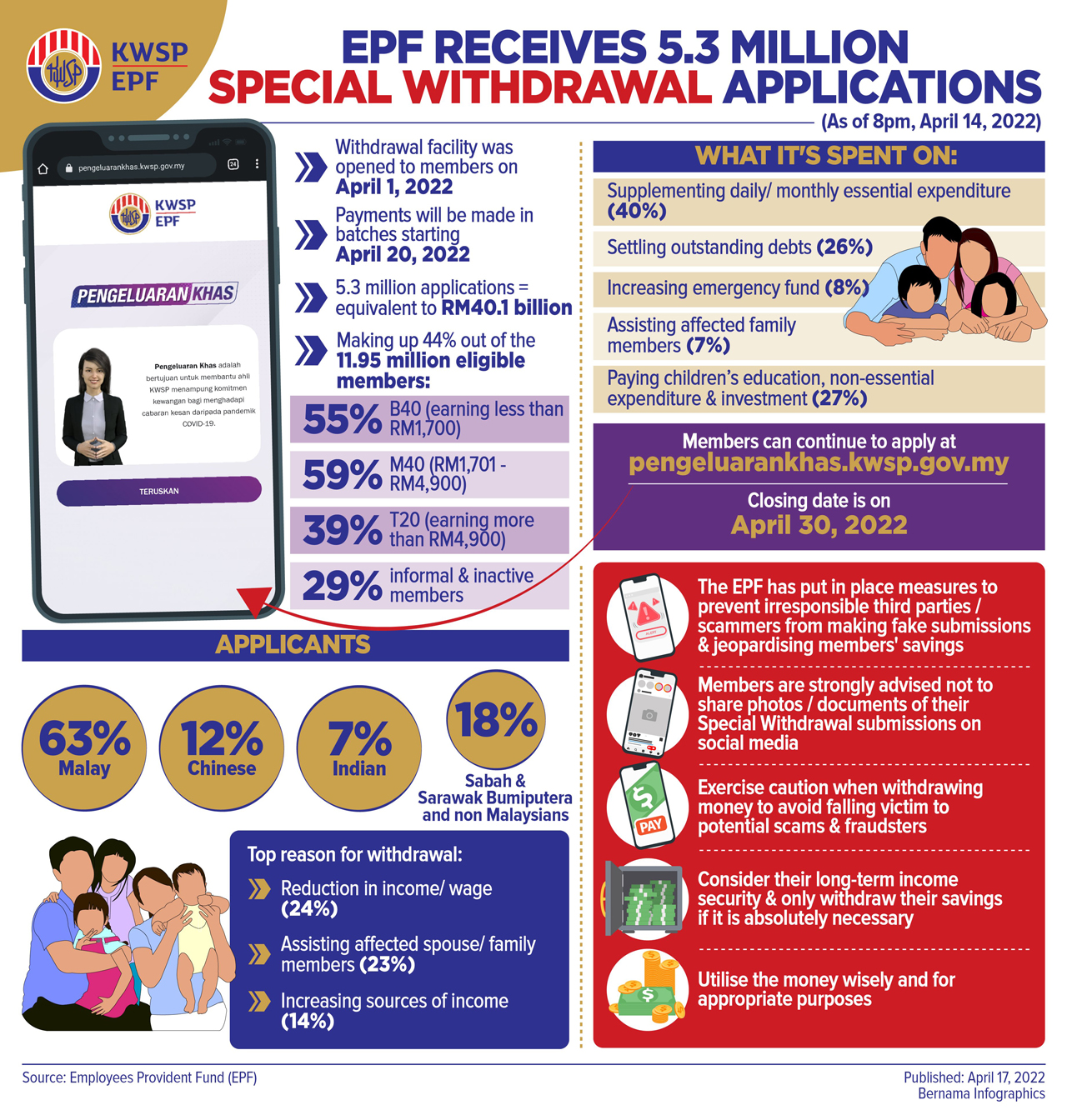

An EPF is a government-managed retirement savings scheme that is compulsory in countries like India Hong Kong Singapore Malaysia Mexico and other countries that are similar to the United States.

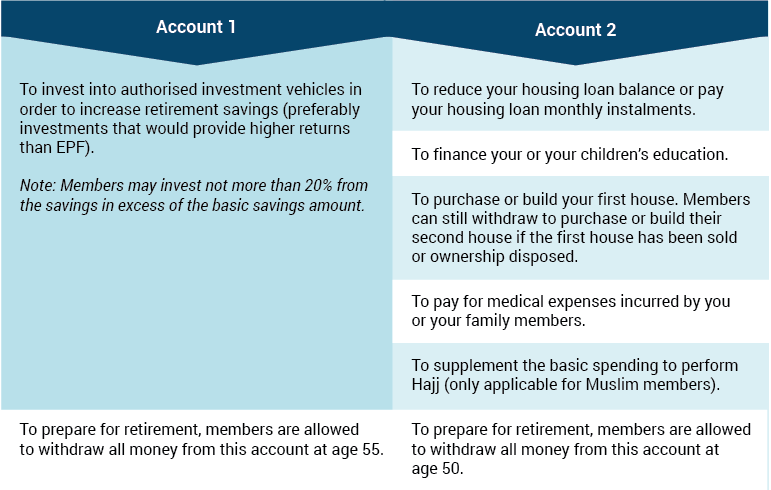

. Withdrawal eligibility only applies to tuition fees subject to the total savings balance in Account 2. Can I make a withdrawal from my EPF Self Contribution. You can only make a one-time partial withdrawal of all or part of your savings in Account 2 when you reach age 50 to help you take the necessary steps in planning for retirement.

2 the Malaysia renunciation process will now take 2 months from time of submitting a request. Entire savings in Account 2 whichever is lower Difference between purchase price and approved loan amount 10 of the purchase price OR Applicants entire savings in Account 2 whichever is lower Self-Financing. Deleted by Act A13002007.

This withdrawal is an extension of the Age 55 Withdrawal and caters for those who have opted for later retirement and continue working after 55 years. Withdrawal from EPF Self Contribution is following the same procedure as the normal EPF withdrawal. Full payment will be made via Foreign Demand Draft in the currency of your choice If your preferred currency is included in our list of approved currencies.

Withdrawal from the Fund Am. 240 Disclaimer. Conventional Account An Annual Dividend payout is credited based on your savings as at 1 January yearly.

KWSP 4 Nomination made before 1 February 2008 will be REVOKED if member has. This post is also available in. 3 u cant seem to get an appointment date from Malaysia high commission unless u submit the letter from ICA which mean u cant do that without completing stage 2 from SG side download the letter from them upon completion.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. 400 units or such other. You can choose to withdraw your savings from Account 2 to help finance your own or your childrens education at approved institutions.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. Malaysia business and financial market news. Melayu Malay 简体中文 Chinese Simplified Employee Provident Fund EPF KWSP in Malaysia.

Your dividends are calculated based on your daily aggregate balance. Bilakah hari terakhir dia perlu bekerja. The purchase cost additional 10 OR Entire savings in Account 2 whichever is lower The purchase cost additional 10 OR.

You can withdraw all or part of the savings from this account at any time. Katakan A ingin berhenti kerja dan mengikut kontraknya dia perlu memberi notis selama 4 minggu. George Town formerly known as Tanjung Penaga is the capital city of the Malaysian state of PenangGeorge Town is Malaysias sixth most populous city with 708127 inhabitants as of 2010 while Greater Penang with a population of 2412616 is the second largest conurbation in the country after Greater Kuala Lumpur.

The Employees Provident Funds EPF registered a total investment income of RM270 billion for the first half of 2022 H1 2022 a decrease of RM706 billion or 21 per cent compared to RM3406 billion in the corresponding period in 2021. Learn more via i-Akaun. All withdrawal payments will be credited directly into yours or your spouses housing loan account when you meet the following criteria.

So that when you find yourself in a tight spot financially you can make a withdrawal from your Account 2 to help cover your monthly housing loan instalment for a minimum period of six months or until your financial recovery. Upon reaching age 55 the contributions made to your Account 1 and Account 2 will be consolidated into Account 55. If the nominee passes away their next-of-kin is eligible to apply for Death Withdrawal.

Youspouse has a housing loan account with a panel bank appointed by the EPF. I-Akaun For registered members only EPF i-Akaun Member Mobile App. Entire savings in Account 2 whichever is lower Difference between house construction cost and approved loan amount 10 of the construction cost OR Applicants entire savings in Account 2 whichever is lower Self-FinancingCash.

Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not. The Star Online delivers economic news stock share prices. Does not require Form KWSP 6A1 2.

Annualised yield is calculated as the most recent monthly dividend distribution multiplied by the Funds dividend frequency and divided by the latest NAV. The historical core of George Town has been inscribed as. When withdrawals are made in 2022 they are eligible to receive withdrawal payments together with dividends at the rate of 2021 for the period of the savings are in.

Members who plan to make full withdrawal in any category after the crediting of 2021 dividend the 2021 dividend will be credited into their account on the dividend crediting date. In an effort to ease the burden of homeowners the EPF introduced the Housing Loan Monthly Instalment Withdrawal. The list focuses on the main types of taxes.

Whereas your monthly contributions will earn dividends based on. Act A10802000 The Board may authorize the withdrawal of all sums of to the credit of a member of the Fund upon any terms and conditions as may be the Board if the Board is satisfied that- the member of the Fund has died. Bank Account details Savings account statementCurrent account statementVerification letter of account holders details from BankEstate Account of the Deceased - under Deceaseds Name.

Mengikut Seksyen 2 1 Akta Kerja 1955 definasi minggu adalah satu tempoh berterusan selama 7 hari. Withdraw via i-Akaun plan ahead for your retirement. EPF stands for Employee Provident Fund.

Applicants entire savings in Account 2 OR Balance treatment cost after deducting the amount withdrawn by other applicants. And the remaining 30 is channelled to EPF Account 2. Check your nomination information at any nearest branch or for faster and easier access to your EPF account use i-Akaun or our mobile app.

Withdrawal application can be made at any time. The construction cost additional 10 OR Entire savings in Account 2 whichever is lower The construction cost. Form KWSP 3 Pindaan for mail submissionsfailed thumbprint verification.

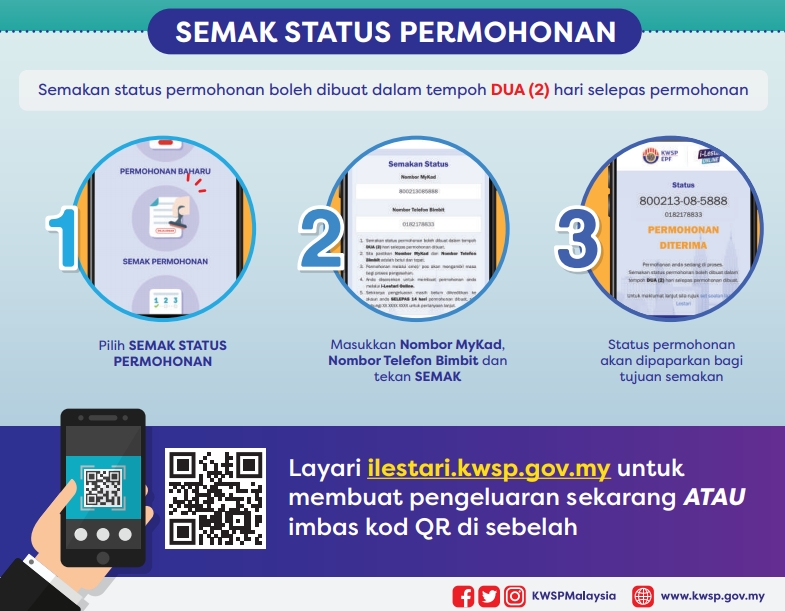

Shall be updated within 3 working days 3. No wonder no kwsp 20k relief no epf withdrawal sampah budget 2023 budget 2023 suck rakyat dry dry KUALA LUMPUR. The employer contribution is taxed at the employees marginal tax rate so the actual amount the employee receives in their account is between 183 and 2685.

Full payment in Ringgit Malaysia RM will be credited to your account If you hold an active account with our panel bank and your identification number matches the bank records. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. Employers are required to contribute at least 3 of an employees gross pay to the employees KiwiSaver account.

Form KWSP 9KM AHL and Checklist. A one-off withdrawal after three years to help buy a first home. Yourspouses loan with the EPF panel bank is not in the non-performing loan NPL status.

Require you to enter your name NRIC and EPF. Personal finance advice from Malaysia and world. The EPF allows members who are having medical problems to make a withdrawal from your Account 2 to help cover the medical expenses for approved illnesses andor healthcare equipment as well as fertility treatment.

The EPF guarantees a minimum 25 dividend through approved investments to ensure your savings are secured.

How To Apply For Epf S Rm10 000 Special Withdrawal And Check Your Eligibility Trp

Malaysia S Employees Provident Fund An Emergency Populist Fund Fulcrum

Epf Withdrawal Utilise The Savings Wisely Imoney

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

Tar Uc Src Application Of Epf Withdrawal Dear All Facebook

Employees Provident Fund Types Of Withdrawal Scheme Ppt Video Online Download

Types Of Withdrawal Of Epf Download Table

I Sinar 8 Other Things You Can Use Your Epf For

Kwsp Epf Partial Withdrawal Education

I Lestari Here S An Easier Way To Withdraw Rm500 From Epf Without Forms Soyacincau

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

The Rundown On Epf Withdrawals

Withdrawal Epf Settlement Education Loan 2020

Longer Wait Time For Next Epf Withdrawal Under Account 2

How To Buy A House With Epf Account 2 Money Properly

Application For Special Epf Withdrawal From April 1

0 Response to "kwsp withdrawal account 2"

Post a Comment